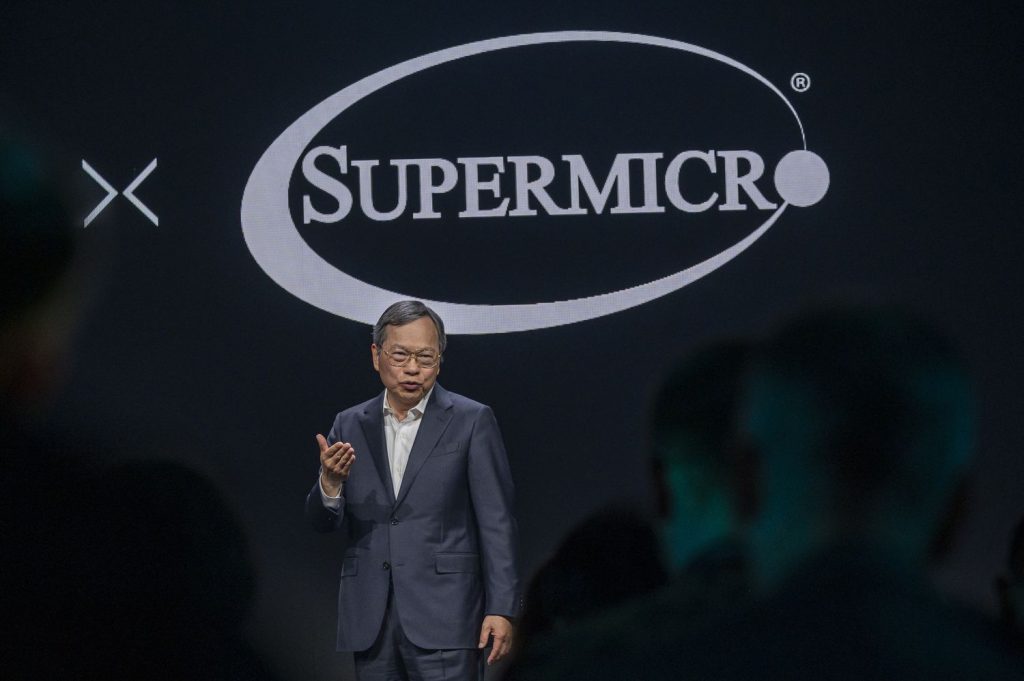

BANDUNG, SEATIZENS.id – Super Micro Computer (SMCI), one of the major players in artificial intelligence technology and data centres, saw its shares fall by more than 30% on Wednesday morning.

The fall follows the surprise announcement that global accountancy firm Ernst & Young (EY) is stepping down as the company’s auditor SMCI .

EY withdrew midway through the audit for the year ending 30 June 2024, stating that it “could no longer rely on the assurances provided by management and the audit committee” and felt that it “could not be associated with the financial statements prepared by management SMCI”.

EY Resignation Reasons

In the official resignation letter, EY stated that the new information they had received raised concerns about the integrity of the data provided by Super Micro’s management.

According to EY, this information led them to conclude that they could not continue the audit in accordance with professional and legal standards. EY added that they were not prepared to be associated with audited financial statements based on data that they considered to be unreliable.

The resignation comes in the middle of the audit of Super Micro’s financial statements for the fiscal year 2024. In a recent filing with the US Securities and Exchange Commission (SEC), Super Micro responded that it ‘disagrees’ with EY’s decision and is working hard to select a new auditor.

Super Micro Response and Effect on Equities

Super Micro sought to reassure shareholders and the public that it continues to work ‘diligently’ to resolve the issues raised by EY. The company added that there was no indication that the previous financial statements would need to be amended or restated.

They also stated that ‘the matter being considered by the Special Committee of the Board’ would not affect the accuracy of the financial statements.

However, this conviction did not seem to be enough to convince investors, as evidenced by the fall in Super Micro’s share price.

The fall in the share price was exacerbated by a report published a few months earlier by Hindenburg Research, which alleged that Super Micro had manipulated its accounts.

Hindenburg, which revealed that it had taken a short position in the company, said it had found evidence of ‘unreported related party transactions, export sanctions and accounting control violations’.

Related Post: Thailand Moves Forward with 300 Bath Tourist Tax

EY Allegations and Resignation Background

The Hindenburg report, published in August, raised suspicions that Super Micro was involved in accounting manipulation and various other offences.

As a result, Super Micro delayed the filing of its annual report, causing the company’s shares to fall by around 20% on 28 August. The delay added to the uncertainty surrounding the company, which has yet to file its 2024 annual report.

The problem was compounded in September when the Wall Street Journal reported that the US Department of Justice was investigating Super Micro for alleged accounting violations.

Anonymous sources quoted by the Journal said that the investigation was still in its early stages, but that a San Francisco prosecutor had requested information about alleged accounting violations by former Super Micro employees.

This investigation is adding to the negative perception of the company and increasing pressure on management to take corrective action.

Super Micro Steps

In its latest statement, Super Micro announced that it will provide a business update on Tuesday 5 November.

The update is expected to shed more light on the corrective measures to be taken and reassure investors amid the market turmoil that has engulfed the company.

However, Super Micro’s challenge is not only to restore its image in the eyes of the public and investors, but also to complete the pending audit.

The selection of a new independent and competent auditor will be a crucial step in restoring market confidence. Meanwhile, analysts stressed the importance of transparency and accountability in restoring the company’s image.

(Mars)